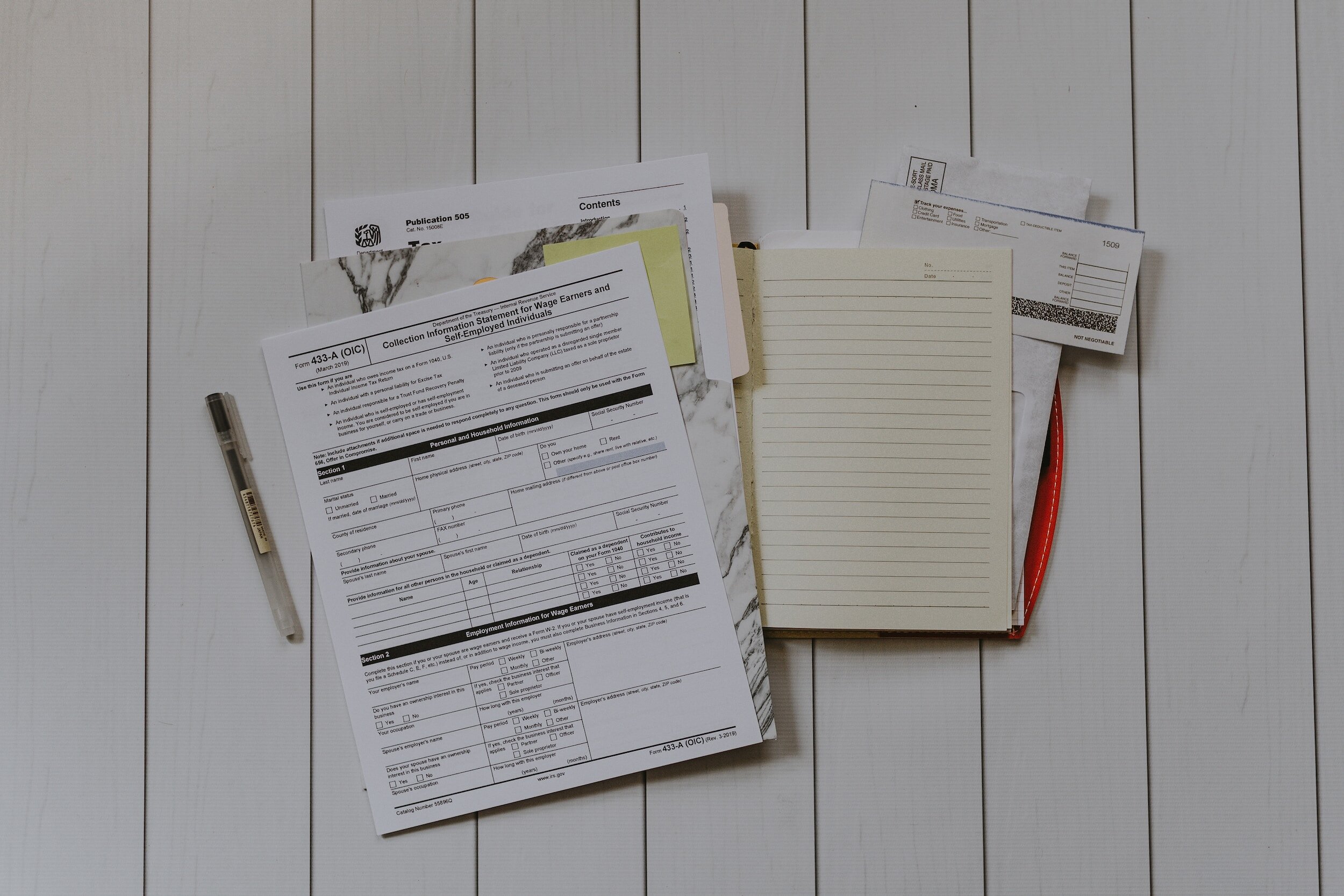

Tax Services

At EHTC, we take a proactive approach to tax services. We understand that you want to grow your business and may be unsure how to handle that growth.

Whether you are expanding your business to other states, unsure what entity your business should file under, or are expanding into new markets, we are able to help you with your needs. By staying current on new tax laws, legislation, and regulations, we work with you to minimize your current and future tax liabilities.

As your business grows, you want to ensure you are doing the right things from a filing perspective and making the best decisions for your company. We understand there are numerous changes to keep up with regarding the constantly changing, complex tax code.

Our Tax team has the experience and education of CPAs, as well as large firm resources through our BDO Alliance USA membership, to handle any situation—no matter how complex.

We specialize in providing high-level tax expertise to businesses and individuals. We work with other accountants and attorneys to enhance the tax services they provide. Our relationships with these professionals provide mutual value without putting their client relationships at risk.

-

Corporate

Individual

Trust/Fiduciary

State and Local

-

Quarterly Calculations

Year End Planning

Choice of Entity Planning

-

Entity choice

Gifting

Trust/Estate Planning

Tax Services Team

-

Heather Kelbel

CPA | Tax Partner

-

Erik Olson

CPA, CVA | Tax & Advisory Services Partner

-

Dave Echelbarger

CPA, CGMA | Managing Partner

-

Mike Young

CPA | Tax & Advisory Services Partner

-

Jo Gould

CPA | Tax Director

-

Ethan Rickelmann

CPA | Tax Senior Manager

-

Martin Robbins

CPA | Tax Senior Manager

-

Michael Kamp

CPA, CVA | Tax & Valuation Services Senior Manager

-

Anna Storms

CPA | Tax Senior Manager

-

Katie Wint

CPA | Tax Operations Manager

-

Spencer Iobe

CPA | Tax Manager

-

Lily Synder

Tax Senior Associate

-

Maddie Boerema

Tax & Advisory Services Senior Associate

-

Drake Shipman

Tax Senior Associate

-

James Hoebeke

Tax Senior Associate

-

Noelle Corcoran

CPA | Tax Senior Associate

-

Kiara Swart

Tax Senior Associate

-

Logan Martens

Tax Associate

-

Jarek Brower

Tax Associate

-

Jayden Kolekamp

Tax Associate

-

Danielle Burkhardt

Administrative Assistant

Focus on your business without having to worry about complex tax issues.

We provide our clients with the taxation expertise and knowledge they deserve throughout the year, so you can be confident in the team of professionals assigned to your account. Contact us to get started.